Why Liberty Is Losing and What To Do About It

SETTING THE SCENE

You could be forgiven for feeling despair at the state of Australian politics right now.

Ditto for the West as a whole.

Unfortunately, despair doesn’t take us where we need to go.

There are four forces pulling us in the wrong direction at the moment. The quick summary is that the Liberty-Authority war is raging but Liberty is losing too many battles, our politicians don’t know how ‘mixed’ our mixed-economy should be and so are preferencing Authority in that war, there’s a kind of matrix hanging over us which makes things hard to change, and we aren’t giving our parliamentarians the right incentives to stop.

What we urgently need is clear-thinking on these four forces, an action plan to counter them and a lot of good people like you to follow the plan.

This article will give you the clear-thinking and the action plan.

Read what follows then decide whether you’ll join the fight.

LIBERTY-AUTHORITY WAR

First, the Liberty-Authority war is raging but Liberty is losing too many battles.

There are two extremes in government: 100% Liberty and 100% Authority.

Total Liberty is a utopia, which can only fleetingly exist before Authority is needed to stabilise it. At 95% Liberty and 5% Authority, stability is possible. Imagine 1880s London or 1980s Hong Kong. In this light-touch government, the enterprising individual flourishes to produce a dynamic, Liberty-loving productive society. Individual independence, live and let live lifestyle, free-trade, creativity, flair, ambition, initiative, vision, self-reliance, energy, innovation and self-actualisation abound. The society throbs with entrepreneurial instinct.

Total Authority is a dystopia, which inevitably collapses from the murder, starvation or flight of millions. It is frequently reformed out of necessity. At 95% Authority and 5% Liberty, the Liberty manifests as a barely-tolerated, hardscrabble barter just to ward-off widespread starvation. Imagine 2020s North Korea or 2020s Eritrea. The economy is small and centrally controlled. Basic needs are unmet. In this despotic, heavy-handed government, enterprise is crushed, initiative regarded with suspicion and people cower in fear and repression, forced into a life of misery. There is no spark in its people, no verve, no passion, no striving, no vivacity.

Australia sits nowhere near these two ends of the spectrum, of course. It would be feeble-thinking however to surmise that we are exempt from the Liberty-Authority war. All societies are subject to it, Australia included, and Liberty is losing.

Consider Authority’s recent wins:

- Border closures

- Vaccine mandates

- Emergency power legislation enshrined and ready for reactivation

- Job terminations over mandates

- QR codes to track your movements and bar entry

- Elected politicians denied entry into parliament

- Peaceful citizens shot in the back with rubber bullets

- Home detention of the population

- Laws requiring employers to gather private medical data

- Secrecy over vaccine purchase terms

- Door-to-door visits for covid vaccine rollout

- Opaque health information about vaccine injuries

- Construction of covid detention camps.

Think that’s the end of it?

First, none of these powers has been removed as covid wanes.

Second, at the time of writing, there were 122 bills before Capital Hill, Canberra. This figure obviously changes but you can review the list at anytime yourself here.

I want you to think of the Commonwealth Parliament as a school of ravenous piranha. Every time a new law is passed, your personal and financial Liberty is being thrown in the legislative pond for thirty seconds. You scramble out with razor cuts all over your bloodied body. Then you’re pushed back in by errant leaders and the populist mob for another gasping swim. Again and again, the body politic is attacked, your Liberty weakened with every new law passed.

During my frantic attempts to call MPs during the covid overreach, part of my epiphany that the Liberal Party – far from being an agent for small government – is complicit in this process was a question I posed to an MP. I asked this person to find out from the Parliamentary Library how many Commonwealth statutes are active. The experts couldn’t come up with a number. We are suffocated with so many laws, we don’t know how many there are!

We’ve fought 121 years in Australia over whether we need more economic and personal Liberty on the one side, and whether we need more Authority and protection on the other.

Authority is winning.

One of the issues is that our fellow citizens are increasingly expecting government to be an end-to-end solution to every risk we face in life. What we demand of our governments is that they increasingly manage the risks of life which we have handled privately in the past. Fear is a powerful motivator.

We have to make our politicians understand that we don’t expect them to carry all the risks in our lives.

As Lord Jonathan Sumption said in a recent trip to Australia:

“If we hold governments responsible for everything that goes wrong, they will take away our autonomy so that nothing can go wrong.”

I think he’s being optimistic about ‘nothing can go wrong’ but you see his point.

MIXED ECONOMY

Second, our politicians don’t know how ‘mixed’ our mixed-economy should be and so are preferencing Authority in that war.

Throughout time immemorial, we have sought to balance these competing but innate needs. On one side, creative, independent, self-actualising Liberty and, on the other side, risk-avoiding, dependent, protective Authority.

Democracy, coupled with its ‘mixed-economy’, tries to navigate between the two. That is, there is constant tension within a mixed-economy democracy to balance Liberty and Authority.

How are each enabled?

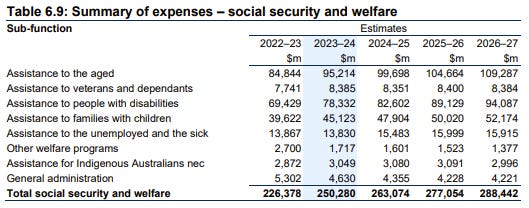

The general rule of thumb is that the bigger a government’s budget, the greater the means by which our leaders can impose Authority.

Big government budget means more Authority and less Liberty.

Small government budget means more Liberty and less Authority.

So, what’s the trendline in Australia.

If we use government expenditure as a percentage of GDP as the litmus test since Federation in 1901, we see an obvious trend. I’m going to use cut-offs at the end of each Liberal government (or its predecessor equivalents) since centre-right Liberals are reputationally supposed to be the small government, pro Liberty advocates.

Here’s what we discover:

- Deakin (third government): 5%

- Menzies (second government): 17%

- Fraser: 26%

- Howard: 37%

- Morrison: 45%.

The trend is clearly from Liberty to Authority.

We need to jettison this old Keynesian term ‘mixed economy’. It’s an umbrella phrase which masks intent. An economy set at 90% Liberty and 10% Authority is a mixed-economy of a sort. So is 10% Liberty and 90% Authority. Even comparing Alfred Deakin’s 5% government economy versus Scott Morrison’s 45% government economy, the two look nothing like each other.

Using the term ‘mixed-economy’ gives licence to the Authority-lovers to execute socialism-creep.

During our lives, government is becoming ever larger and the piranha are being fed. Government has the growing means to intervene, coerce and limit our Liberty by a thousand imperceptible cuts over time.

And the truth is that the Liberal Party has been completely unsuccessful over 121 years in reversing the trend.

Why?

TOCQUEVILLE’S MATRIX

Well, third, there’s a kind of matrix hanging over us which makes things hard to change. I call it the Tocqueville Matrix.

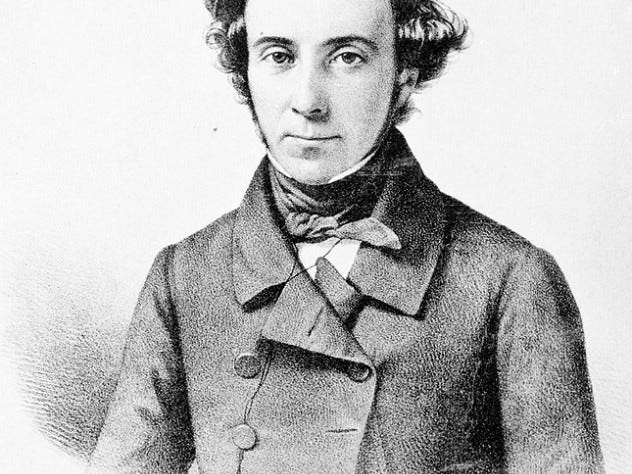

The answer is that we’re in a system bigger than ourselves. We can laugh at analogies with the film The Matrix all we like. However, the reality of our predicament today was well uncovered, not by the hacker Neo in that movie but, 187 years ago by the classical liberal philosopher Alexis de Tocqueville in his celebrated essay “Democracy In America”, the result of a fact-finding mission for France.

Though published in 1835 on the other side of the planet, it was highly relevant to Australia at the time. The free-settled Province of South Australia was just one year from proclamation. A mere fifty-four years later, Sir Henry Parkes delivered his famous Federation-rallying Tenterfield Oration in which he said “Surely what the Americans have done by war, Australians can bring about in peace.”

Here’s what Tocqueville witnessed of the new American republic, at this point only two generations old. As you read his words, pay attention to the creaking tension between Liberty and Authority, and the ongoing, overall impact of democracy on its people:

“The protecting power of the state extends its arm over the whole community. It covers the surface of society with complicated rules, minute and uniform, through which the most original minds and the most energetic characters cannot penetrate to rise above the crowd. The will of Man is not shattered but it is softened, bent and guided. Men are seldom forced to act but they are constantly restrained from acting. Such a power does not destroy but it prevents existence. It does not tyrannise but it compresses, enervates and extinguishes. It stupefies a people until each nation is reduced to nothing better than a flock of timid and industrious animals to which the government is the shepherd.”

Dare tell me this is not Australia in 2022.

I’ve shown you our legislative losses. I’ve revealed the legislative agenda in progress. I’ve shared that we don’t even know how many laws are on the books. This is Tocqueville’s ‘complicated rules, minute and uniform.’

Further, who are our ‘most original minds and the most energetic characters’? We may not be shattered as a people. But who will deny we are ‘softened, bent and guided’?

The word ‘enervates’ means ‘to make a person drained of energy or vitality.’ If this is how you feel right now about politics, it’s the Tocqueville Matrix of democracy working you over! Resist it. Let your innate self-reliance and self-actualisation radiate.

I could have sworn Tocqueville was in Australia from 2020-2022 when writing that last sentence.

If you feel that your fellow citizens exhibit foggy thinking, if you believe they make terrible electoral choices, then take heart. We know why …

Australia, like all Western liberal democracies, has placed an apparatus over its citizens. This apparatus of uncountable statutes and a million regulatory miscellany soften, bend and guide us. Initiative, vigour and swashbuckling verve are all discouraged as is self-reliance. Our innate creativity, independence and self-actualising Liberty has been dampened. We are less Errol Flynn, Sir Charles Kingsford Smith and Sir Douglas Mawson, and now more a half-thwarted version of our true selves.

Authority has taken over Liberty as the primary force in Australia. We accommodate too much. We fund too much. We have power-hungry, entrenched legislators. Our fellow Australians are too prone to expect government to manage all the risks of the world.

PARLIAMENTARY INCENTIVES

Fourth, we aren’t giving our parliamentarians the right incentives to stop.

Our politicians, specifically the ones housed in the seat-holding incumbency parties of Labour, Greens, Liberals and Nationals, often spend ten to twenty years working towards preselection. They aren’t going to rock-the-boat once in power after that investment of time.

We need term limits. We also need the hard work within party preselection processes to turnover long-time incumbents.

Another issue is that we, as a people, are simply unpractised to tell a politician ‘no’! We advocate for spending on our pet projects and our politicians say ‘yes’ to everyone. It’s unsustainable. And when we argue for cuts, we are vulnerable to the ‘what government program are you going to end?’ We need a coherent, well-practised push-back to this. Citizens can’t keep acting like toddlers asking for more and politicians need to be disciplined in saying ‘no’.

We are terrible at applying constant pressure on our representatives between elections. They rarely hear from us after a poll. We need to visit them, form relationships with them, lobby them, guide them and, yes if necessary, threaten them with electoral backlash.

In fifty-four years, I’ve not seen one protest outside an electorate office by citizens angry about the MPs big spending tendencies. Not one.

We aren’t giving them the right incentives to correct.

AN URGENT ACTION PLAN

So, here’s what you need to do.

For Liberal and National members:

Action 1: Gather fellow members and advocate for a three-term limit. Make clear to an MP in his or her third term that this is it. Say it’s not personal, it’s a systemic position about renewal. Encourage challenges if the MP won’t budge.

Action 2: Make clear at State Council that you demand budget reductions in government. Educate MPs on the importance of reducing budgets. Ask for their game plan to achieve this. Embarrass elected officials who lack the courage to reduce the size of government. Normalise talk of smaller government. As a group or faction, make clear you will be targeting MPs who don’t work towards this.

Action 3: Gather fellow members and internally advocate for policy not tactical preferencing. Discourage tricky tactics which ultimately splinter the centre-right. Shame and seek the removal of any state director or parliamentary leader who supports tactical preferencing to Labor or the Greens ahead of the more Liberty-friendly emerging parties.

For members of the Liberal Democrats, the United Australia Party, One Nation, the Nationals outside coalition, the Shooters, Fishers and Farmers and the Democratic Labor Party:

Action 4: Write to the local MP. Meet and lobby the MP. Educate the MP. Make clear that you want the next budget to be less than the current one. Make clear you want government expenditure as a percentage of GDP to be 40%, then 35%, then 30% and so forth year by year

Action 5: Advocate for a formal coalition and joint tickets. Joint tickets are important. They plug the preference leaking so prevalent on the centre-right. Work towards agreement that each emerging party gets to lead one upper house race. This is a near-guaranteed strategy for a bloc of six senators.

Action 6: Organise in vulnerable Labor lower-house seats to perform what I call the Purple Flip. This is Teal but in reverse. Identify and draft well-known local leaders to run as independents, perhaps tradies or sports figures, who project their working-class background but, due to their success, lean centre-right for its aspirational, social mobility message. Publicly appeal to aspirational voters in these Labor electorates, say they’ve been forgotten by Labor, and privately convince the die-hard but never electorally successful Liberals and Nationals in the seat to vote tactically for the independent.

The simple truth is that, if you don’t take these actions in concert with like-minded centre-right people, that big government trendline will continue to 50%, 57%, 63% and so on.

In democracy, you have to fight for the right balance between Liberty and Authority. Liberty is losing the battle for dominance. We are fast heading to an Authoritarian Australia. Covid overreach surely taught us that. Looming issues of digital passports, facial recognition systems and digital currency are facing Liberty-lovers right now.

You must act. The alternative is that you live, as Tocqueville pointedly wrote, as a ‘timid and industrious animal’ or we just continue to scratch-around in the political wilderness.

We can do better. Let’s steel ourselves now for the battle ahead.

Take a stand.

Join the fight.

Make your declaration in the comments below.

An entrepreneur who has employed 1,470+ people, Kenelm was admitted to the BRW Fast 100 three times with businesses in Australia, NZ, Singapore and New York, where he lived for 12 years. Kenelm’s investment firm performs mid-market leveraged roll-ups. He was a regular columnist for the Australian Financial Review. Kenelm is the Founder of Liberty Itch.