A Nation of Takers

One of the many inequities of Australia’s welfare system is the exclusion of family homes from the means test. Recipients of age or disability pensions can own houses worth millions of dollars while remaining eligible for pensions funded by the taxes of people who cannot afford to buy a house at all.

In private, many politicians agree that excluding the family home leads to unfair consequences. However, neither side of politics is willing to change it. There are simply too many Australians who insist they are entitled to a pension.

It is much the same with the National Disability Insurance Scheme (NDIS). It is widely known to be extensively rorted, with scheme providers charging participants several times what they charge non-participants for the same service. It is also well known that many people on the scheme are only mildly disabled, if at all. And yet, even as the cost threatens to bankrupt the country, even minor reforms prompt screams of protest.

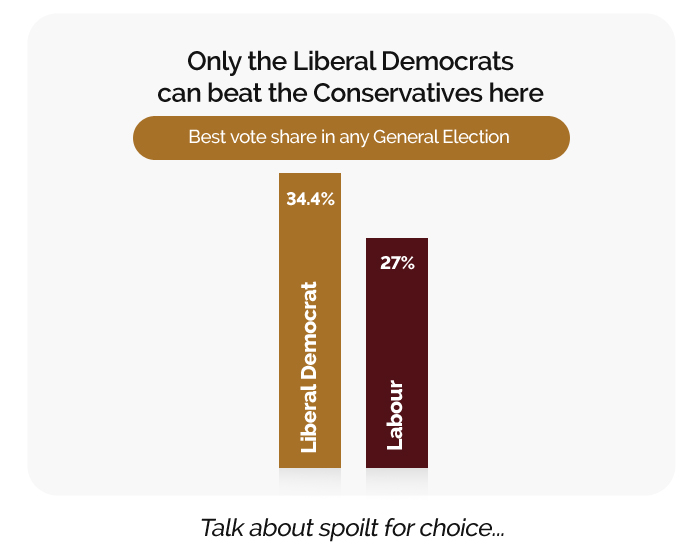

Australia relies more heavily on individual income taxes than other developed countries

Also threatening the national budget is the cost of childcare. It is no longer sufficient to keep small children happy while their parents are at work; it is now early education. Advocates have created a narrative that children who remain home with their mothers are somehow deprived. Childcare is rapidly becoming yet another entitlement to be funded by the government.

There was a time when Australians liked to think of themselves as self-reliant and quick to help each other, while receiving welfare was an embarrassment and an indication of failure.

This has been replaced by a culture of entitlement in which there is absolutely no compunction about receiving money from the government. Many people insist they have a right to a pension simply because they have paid taxes, despite that never having been the situation in Australia. Even those who have never paid tax (apart from GST), or who frittered their savings away on gambling and ‘substance abuse’, demand it.

Some of this thinking is attributable to the fact that a proportion of immigrants originate from countries which have contributory pension schemes. They assume it is no different in Australia. But a far bigger factor is the entitlement mentality. If someone else can get a pension, I should also get it. If someone else is receiving benefits via the NDIS, it’s only fair that I obtain them too. In fact, if there is money being handed out for anything, I’m entitled to it.

There is no longer any disgrace in receiving government benefits. Indeed, a thriving industry of accountants and Financial Planners specialises in rearranging their client’s affairs to meet eligibility requirements for government benefits, especially pensions and the Commonwealth Seniors Health Card.

There is even intergenerational welfare, with extended families living on welfare their entire lives. This is particularly the case with certain indigenous communities, while “Lebanese back” is apparently sufficient to qualify for a disability support pension.

Some admit that ‘government money’ originates with taxpayers, but it makes little difference. The sense of entitlement defies guilt, facts and reason, hence the reluctance of politicians to make changes for fear of losing votes. Even worse, many politicians use taxpayers’ money to buy votes.

The sense of entitlement owes it origins to the growth of the welfare state over the last half century, together with the rise in taxation that accompanied it. Although Australia has had an age pension for more than a century, disability assistance, childcare subsidies, unemployment benefits, medical benefits and many other handouts and subsidies are far more recent.

It has led to the perception of an all-pervasive government with unlimited resources. Moreover, if you go about it the right way, money can be extracted from it.

Also a factor is the level of income tax. Getting something back from the government to compensate for the amount of tax paid makes sense. Australia relies more heavily on individual income taxes than other developed countries, on average taking 25% of earnings. Plenty of people see little benefit for themselves.

Obviously, this situation is unsustainable in the long term. As Margaret Thatcher once said, “The problem with socialism is that you eventually run out of other people’s money.”

Australia is already living beyond its means, with budget deficits year after year. It is also actively discouraging industries that support the economy – think coal exports, gas exports, sheep exports – while increasing energy costs. It obviously cannot last.

What the country needs is a government that encourages self-reliance rather than dependence on the state. Unfortunately, there is no sign of that.

Got something to say?

Liberty Itch is Australia’s leading libertarian media outlet.

Its stable of writers has promoted the cause of liberty and freedom across

the economic and social spectrum through the publication of more than 300 quality articles.

Do you have something you’d like to say? If so, please send your contribution to editor@libertyitch.com

David Leyonhjelm was an Australian Senator from 2014 to 2019 representing New South Wales for the Liberal Democratic Party. Notable for his libertarian consistency, David’s work in Senate Estimates attracted acclaim worldwide for its forensic examination of government

waste. Professionally, he is a veterinarian and agribusiness consultant.