Full House?

As Australia grapples with a crisis of housing supply and affordability, the ‘M’ word is rapidly re-entering the lexicon, this time from both the conservatives and progressives. Yet I can’t help but wonder whether and how much Australia’s current levels of migration influences issues such as housing affordability. I believe this is a red herring that has allowed proper scrutiny of resource allocation within Australia to be lazily sidestepped.

Everyone – from economists to politicians and everyday Australians – loves simple solutions to complex problems. The so-called ‘housing crisis’ is no different, and this time the primary culprit appears to be immigration. In the midst of skyrocketing costs and severe shortages of materials, new housing construction is far from meeting growing housing demand.

Not only do we have an unrealistic image of what type of dwelling or location we need to live in, but both taxes and regulation act as a disincentive to the type of nimbleness that a housing ‘crisis’ demands.

The affordability of houses and land has long been an economic challenge in Australia and, as Bob Day pointed out, vested interests tend to keep it that way. High house prices are politically popular given many Australians own their homes, but they also form the backbone of state budgets through inflated stamp duty and land taxes.

There is another angle here too – Jobs and Skills Australia reported last month that a whopping 36% of occupations in Australia are experiencing a worker shortage. An economic vacuum exists that can only be filled in the short term by migration – yet apparently there is nowhere to house them.

Or is there?

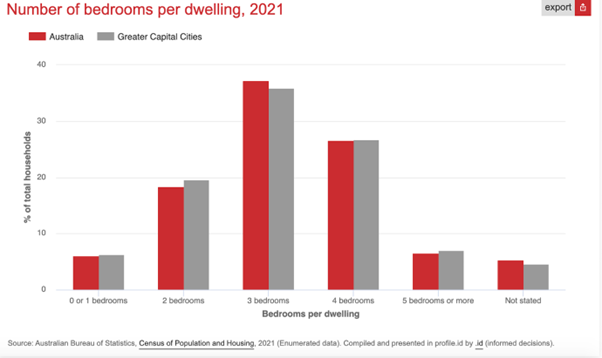

Let’s take a look at a couple of graphs …

What this shows is that the most common type of dwellings in Australia have three or four bedrooms, yet the most common household sizes are single or two occupants. There is also a trend towards rates of single and two person households that has slightly accelerated in recent years. Do we have a ‘housing crisis’? Or do we have a ‘misallocation of housing crisis’?

It sounded callous and out of touch when ex RBA Governor Phillip Lowe told Australians to rent out an extra room or move in with mum and dad if cost-of-living was beginning to bite. But perhaps he was right. Maybe it’s not a case of Australia lacking the space for migrants, but that we lack the capacity to house each single or two-person household independently in their own dwellings. An attitude shift might be necessary.

This is highlighted by the fact that migrants on the whole – particularly the international students who anti-immigration economists have in their sights – are in fact adapting to the housing crisis much better than existing citizens. Housing researcher Dr Zahra Nasreen found that the majority of Sydney’s shared house accommodation was filled by international students and other migrants, along with young professionals.

Along with the drip-feeding of land supply, which artificially inflates prices, the difficulties in construction, the regulatory burden that stifles higher density infill, and the migration program, misallocation is a substantial contributor to our housing shortage.

Do we have a ‘housing crisis’? Or do we have a ‘misallocation of housing crisis’?

A major reason for this is stamp duty, which is an insidious block on housing mobility – punishing home-owners financially for up-sizing, down-sizing, or moving closer to employment opportunities. If we are to utilise our existing and future housing stock to its fullest capacity, we must abandon this tax.

Another reason is that family homes are not taken into account when assessing eligibility for welfare payments such as aged and disability pensions. This creates an incentive to remain in homes that, if sold for something smaller, would create surplus funds and threaten eligibility.

So far governments around Australia, particularly in Victoria, have simply targeted landlords, holiday home owners, short stay accommodation providers and empty land owners with new taxes and regulations. It is about time we had a serious conversation not only about how to increase our housing supply but how to maximise use our existing stock.

Not only do we have an unrealistic image of what type of dwelling or location we need to live in, but both taxes and regulation act as a disincentive to the type of nimbleness that a housing ‘crisis’ demands. Before we as libertarians abandon important principles such as freedom of movement and succumb to the allure of protectionism, we ought to ensure migration really is the problem they say it is.

Max Payne is the Australian Program Associate with Students For Liberty, a global non-profit that spreads the values of libertarianism on campus. He is also a twice former candidate with the Libertarian Party and maintains a keen interest in Austrian economics, classical music and organic gardening.