Victoria: Back in the Basket Again

Reproduced with permission from The BFD

https://thebfd.co.nz/2024/05/09/victoria-back-in-the-basket-again/

I grew up in Victoria (don’t judge me, it wasn’t always the way it’s become), and lived through the dark days of the early 90s. Back then, it seemed that hardly a week went by without another economic calamity: the Pyramid building society collapse, the Tricontinental bank collapse, the State Bank of Victoria collapse, and the Victorian Economic Development Corporation collapse.

Not to mention the collapse of the Victorian branch of the National Safety Council of Australia under a cloud of embezzlement. The state’s credit rating plunged from a gold-standard AAA to an embarrassing AA+.

Fun times.

Well, to spin the old Chinese curse, Victorians are living in fun times again. The most indebted state in Australia, and diving deeper into the red for the foreseeable future. Once again, all at the hands of a Labor government.

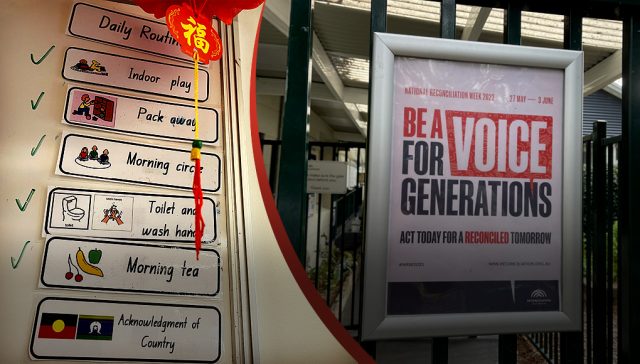

It’s clearly not as if there’s no room for cleaning out the bureaucracy in Victoria.

The state’s credit rating is now a dire AA, and under threat of plunging further — which makes even paying off debt more expensive.

Over the four financial years covered by the budget, the annual interest required to service Victoria’s debt will jump from $6.3 billion to $9.3 billion. This is a serious chunk of change and, as a statistical quirk, the fastest-growing expenditure item listed on the government’s cash flow statement.

Victoria’s net debt – the total amount we owe – is forecast to pass $187.8 billion by July 2028 on the way to an unknown, distant peak. It is unfair to characterise it as a mountain because, at this point, there is no downward slope discernible to Treasury officials.

“As a proportion of gross state product, Victoria’s net debt is going to be higher than it was at the end of the Cain/Kirner years,” says economist Saul Eslake. “If I was a Victorian taxpayer, I would be worried about that.

“Certainly outside of Victoria, everyone thinks Victoria is a basket case.”

Astonishingly, Victorian Treasurer Tim Pallas claims the debt has “stabilised”.

In the six months since Pallas published his last update of Victoria’s finances, the bottom line has gone backwards by $2 billion.

In the mid-year budget review tabled in December, the cash deficit for 2023-24 – the total revenue raised by the government less everything it spends – was forecast to be $13.1 billion. On Tuesday, that figure was revised to $15.2 billion. The Age

So very stable.

Over the four financial years covered by the budget, the annual interest required to service Victoria’s debt will jump from $6.3 billion to $9.3 billion.

Remember when Dan Andrews promised 4000 ICU beds? Yeah, neither does he. In fact, Victoria’s health system — traditionally a Labor strength — is in for a major trimming-down. Although, in a rare departure for any government, let alone Labor, it seems as though it’s bureaucratic fat that’s getting cut.

A leaked document, seen by this masthead, reveals one of the options is mergers – or “consolidations” – which would mean many existing health services would lose their own chief executive and local boards and have them replaced by an advisory board.

It’s clearly not as if there’s no room for cleaning out the bureaucracy in Victoria. The state has 76 health services, compared with 17 in more populous NSW, 16 in Queensland, 10 in SA, five in WA, and just three in Tasmania. Even New Zealand only has 20 district health boards.

But that’s not how it’s going to be spun by vested interests. Labor risks getting on the wrong side of the powerful hospital unions. Already, the complaints are starting.

It doesn’t look as though the budget is buying Victorian Labor any love at all.

Treasurer Tim Pallas said his 10th budget would help families, but the only sweetener was payments of $400 per child from next year for the families of students in Victorian public schools and concession cardholders at non-government schools. The Age

In fact, if The Age’s vox pop is anything to go by, not many “key stakeholders”, as the jargon goes, are particularly happy.

Certainly not young families, commuters, or small business owners.

In 92, it took the mongrel of Jeff Kennett and Alan Stockdale to fix the Victorian basket case.

Who’s going to save Australia’s Wokest State from itself, this time?

Punk rock philosopher. Liberalist contrarian. Grumpy old bastard.

I grew up in a generational-Labor-voting family. I kept the faith long after the political left had abandoned it. In the last decade or two, I’ve voted at times for just about all of the major parties and quite a few of the minor ones.

My vote may have changed, but those basic working-class values I grew up with never have.