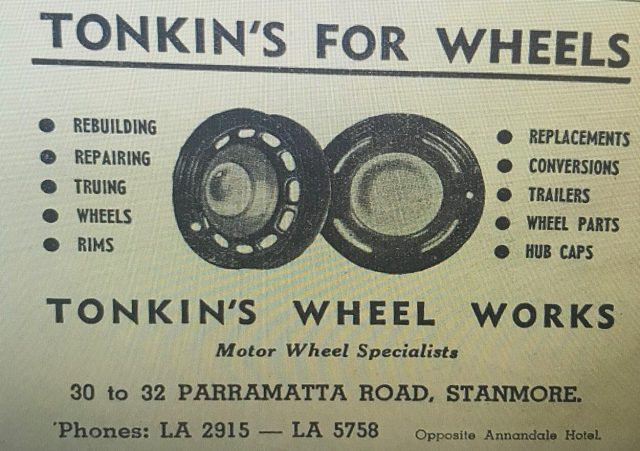

Remembering Bert Kelly

In my last piece, Remembering Frederick Douglass, I discussed the evils and folly of centralised wage-fixing which, amongst other things, prevented people – young people in particular – from getting a start in the workforce; a foot on that first rung of the employment ladder. Today, we look at centralized wage-fixing’s partner-in-crime – tariff protection. The other side of the micro-economic...

VOTE NOW! Tucker Carlson or Ben Shapiro?

Let’s do something different today, yes? I’m normally beavering away, sharing my opinions with you. Today, though, you’re in the driver’s seat. I’d like to hear from you. So this is what we’re going to do together … I’ll give you a short video to watch. It’s only 1:54 minutes long; You watch it. It’s a discussion between Tucker Carlson and Ben Shapiro. They...

Eye-Opening Dispatches From Vietnam

After three long years of covid lockdown-induced solitary confinement, a loyal Liberty Itch subscriber cut loose, left Australia for South-East Asia and found herself in Vietnam. Animated by what she saw, I started to receive her much-welcomed dispatches about daily life there. Now, if you read any 1960s and 1970s history, you know Vietnam is communist. But what my friend’s streetscape dispatches reveal...

ANSWER: The Carlson-Shapiro Question

I admit it. There I was on 27 February 2023, making a little mischief with my article: VOTE NOW! Tucker Carlson or Ben Shapiro? Well, it was mischief-making in the sense that I like to sharply define the line between liberal and conservative and then, with all the goodwill in the world, provoke people to think and explore these differences. There is a difference, you...

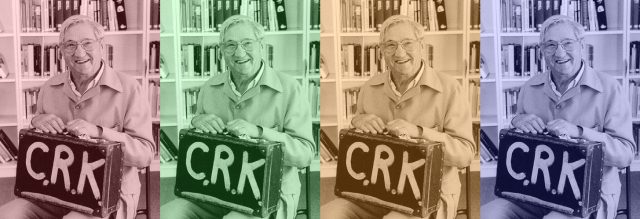

FREE! The Kerry Packer Classical Liberal Masterclass

Some thirty plus years ago, a fellow by the name of Kerry Packer appeared before a House of Representatives Inquiry into Print Media. The context of the inquiry was that the owner of the main metropolitan newspapers and classifieds, Fairfax, had gone broke. And with Fairfax having gone broke, Packer was trying to buy into the re-floated business. This was a...

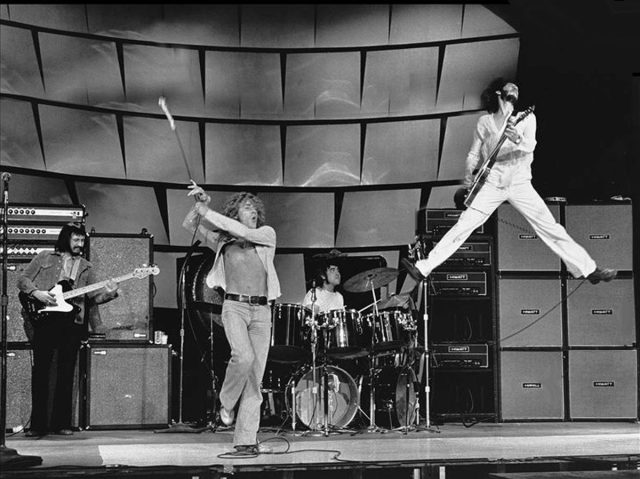

Talkin’ About My Generation (Part 1)

In his excellent Liberty Itch post Golden Years last week, Max Payne writes, “By the time today’s young people are finally ready (or allowed) to retire, they may find they face a double challenge. First, their superannuation funds might have been ransacked by previous generations; second, the availability of quality care may be limited due to the challenge of...

The Consequences of Rent Control

As Australia faces a rental crisis, the Greens are agitating for rent control. Chief among their voices is Adam Bandt, whose clarion call is: “Unlimited rent increases should be illegal.” The Greens and their cheer squad claim rent control protects tenants from excessive rent increases and provides affordable housing options. Such policies would be implemented in response to affordability concerns,...

4 Free Enterprise Policies Guaranteed To Make The Economy Roar!

Red tape is a productivity-sapping and innovation-destroying virus on business. Australia is feeling the effects of a generation of governments that believe any problem in the world can be solved with another little rule, constraint or compliance requirement. Australian business is suffering death by a thousand cuts. There are too many rules to actually know and obey. It’s worse than a mere...

Live Sheep Export: Labor’s Sacrificial Lamb

The Albanese government manufactures political support using sacrificial lambs. One lamb lined up for sacrifice is the live sheep export industry. The Department of Agriculture, Fisheries and Forestry website currently states that “The Australian Government has committed to phasing out live sheep exports from Australia by sea”. Labor demurred when questioned pre-election, but the WA Labor platform clearly articulates the...

Smaller Government: Georgia Shows It’s Achievable

To any true libertarian, Government regulation in Australia feels increasingly suffocating. This feeling is backed by statistics. According to the Parliamentary Education office the Australian Government added an average of 109 new laws every year from 1901 to 2013. Since 2013, that increased to 139 new laws per year. Typically, when the Government is criticised for its interference in our...