In my last piece, Remembering Frederick Douglass, I discussed the evils and folly of centralised wage-fixing which, amongst other things, prevented people – young people in particular – from getting a start in the workforce; a foot on that first rung of the employment ladder.

Today, we look at centralized wage-fixing’s partner-in-crime – tariff protection. The other side of the micro-economic coin, if you like.

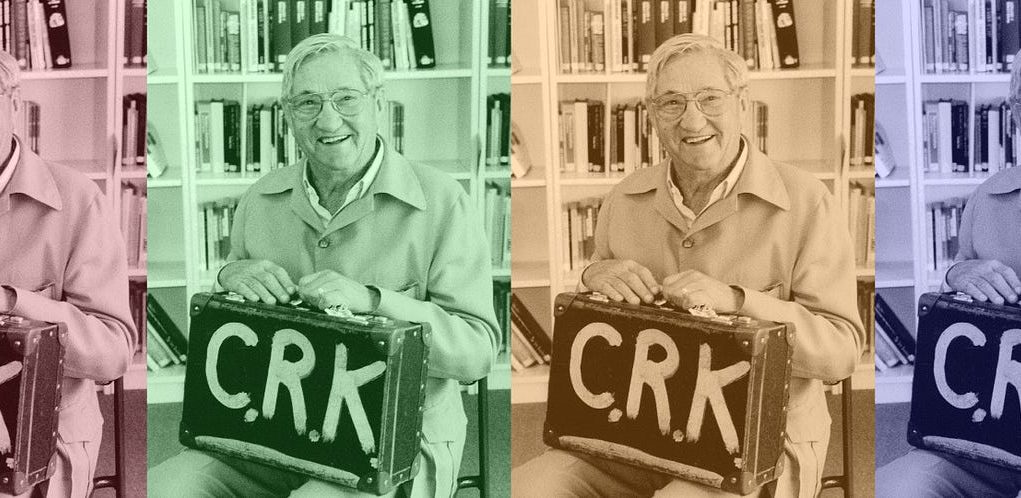

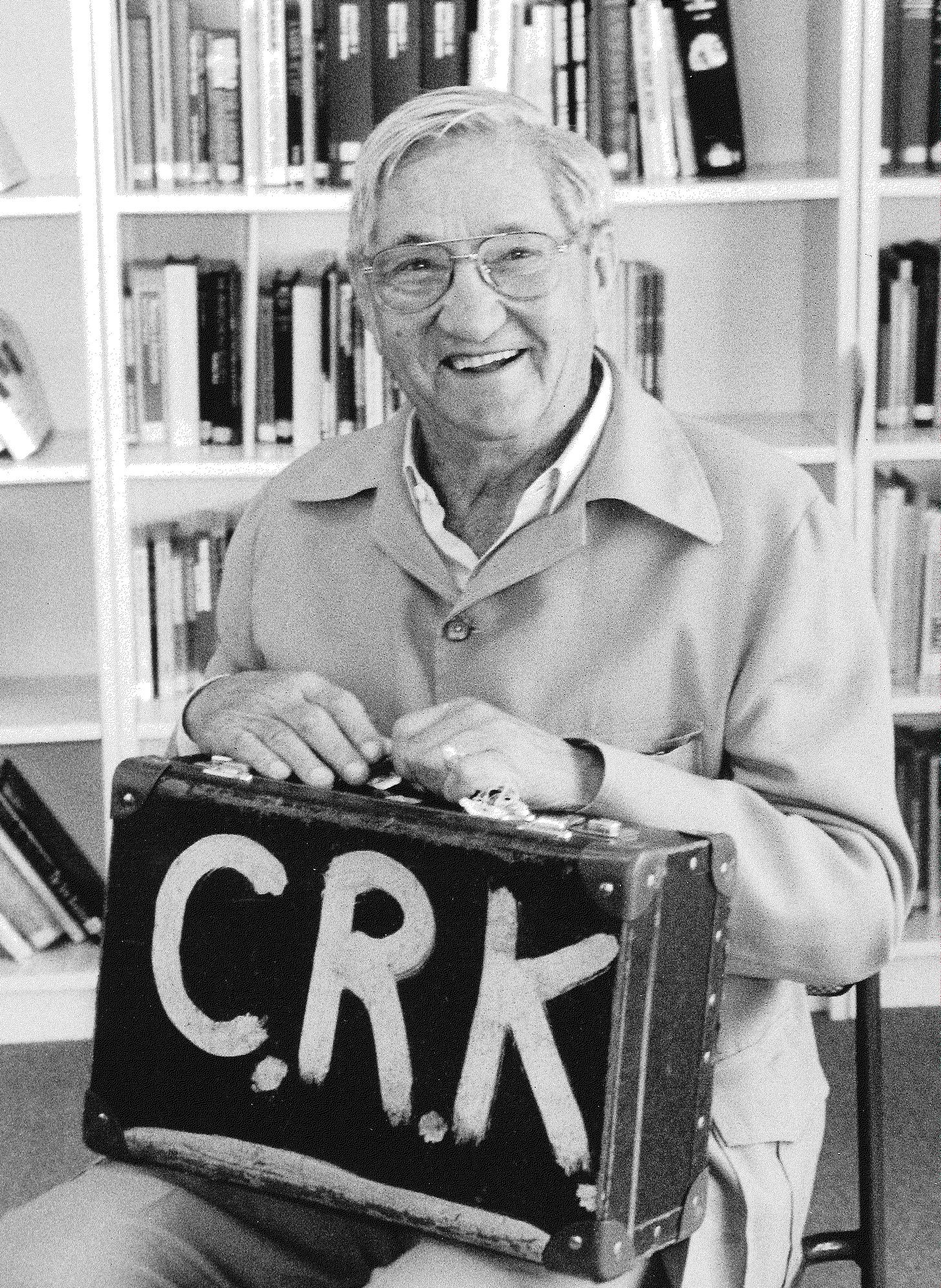

It was Bert Kelly (1912–1997) who once said, ‘The really bad ideas never go away’.

Along with centralised wage-fixing, protectionism is another of those really bad ideas.

The Australian settlement of 1900 was based on five key principles – two were economic, two were social and one was the imperial benevolence of the mother country.

The two social principles were the White Australia Policy and State Paternalism.

The two economic principles were regulated labour markets and tariff protection. These two went hand in hand. As centralised wage-fixing delivered arbitrary pay increases, thus increasing the cost of production, the price of the goods rose commensurately. As a result, imported goods became more competitive. In response, an import tax – a tariff – was placed on these imported goods to ‘protect’ Australian jobs from competition.

By the late 19th century, NSW had prospered under its free trade regime and had overtaken protectionist Victoria, becoming the continent’s leading colony. Following the collapse of the gold-rush, and to sustain its economy, Victoria borrowed heavily in the British capital markets but soon found itself impoverished and losing population – the consequences of 30 years of protectionism. NSW political leaders such as George Reid speculated that Victoria was desperate for federation so that its economic problems could be shared with the other colonies!

By the early 1920s, the newly-formed Country Party under Earle Page – influenced by the rural export industries of wool, meat and wheat – was officially opposed to protection, yet supported the Scullin Government’s belief that tariffs on imports would help restore employment during the Great Depression (1929–1932) by handing out tariffs virtually on demand. It didn’t work.

In 1930, Australian historian Keith Hancock had published his book Australia which contains this memorable reference to protectionism in Australia:

‘Protection in Australia is more than a policy: it is a faith and a dogma. Its critics, during the second decade of the twentieth century, dwindled into a despised and detected sect suspected of nursing an anti-national heresy. Protection is interwoven with almost every strand of Australia’s democratic nationalism. It professes to be a policy of plenty, but it is a policy of power.’

Bert Kelly arrived in Federal Parliament in 1958 as the Member for the South Australian seat of Wakefield and from then until he left the Parliament in 1977 fought a long and often bitter campaign against protectionism – first against a very powerful Deputy Prime Minister and Country Party Leader in John ‘Black Jack’ McEwen, and then against the strongly-defended populism of ‘protecting Australian jobs’.

Bert Kelly was opposed to protectionism because, like centralised wage-fixing, it was not only economically foolish, it was also morally wrong. It was wrong, he said, because it created a situation in which governments granted favours to some, who became greatly enriched, at the expense of others, who were at best impoverished and at worst, ruined.

On a parliamentary delegation to India, Bert visited a factory making bed sheets which wanted to sell in Australia but was unable to do so due to the high tariff (import tax) placed on imported bed linen. It was the same at an Indian shirt factory.

For example, a shirt made in Australia cost $50 to buy. An imported shirt $20. By imposing a $30 tariff on the imported shirt, consumers were told they had to pay $50 for a shirt to ‘protect Australian jobs’. If there were no tariff, however, and consumers were able to buy a shirt for $20 instead of $50, that would give them Bert argued, $30 to spend on something else. And it is that something else that is the catalyst for emerging industries.

Tariffs support declining industries, free trade supports emerging industries.

Bert also learned that Indians were desperate to buy Australian milk powder for their children but did not have the foreign exchange – Australian or US dollars – due to the insurmountable tariff on their textile goods entering Australia.

Thus, both India and Australia suffered. To quote Bert Kelly:

‘Australian dairy farmers can’t sell their skim milk powder, Australian families have to buy expensive ‘Australian-made’ sheets and shirts, Indian children don’t get milk and Indian factories can’t make textiles. A lose-lose situation if ever there was one. All this brought to you by our good and wise government’.

At the same time, Australia was giving aid money to India.

Bert spoke frequently in favour of Community Aid Abroad but against aid being given with no strings attached. ‘Trading with poor countries is a far better way to help them than giving them aid,” he argued.

With the union movement’s new friends in Canberra, expect to see more on the wages/tariff front.

Thank you for your support. To help us in our battle to protect liberty and freedom please click here

Bob’s contribution to the Australian community has been reflected in a wide range of appointments including National President of the Housing Industry Association, Co-Founder and Inaugural President of Independent Contractors of Australia, Director of The Centre for Independent Studies, and Senator for South Australia.