Reform of the Reserve Bank of Australia (RBA) has been in the headlines. The problem with the RBA however is not structural. It is a failure by the members of the board to be able to adequately define “inflation”.

At the heart of all the angst is the statement made by the RBA Governor, Philip Lowe, in 2020 that he did not think interest rates would rise until 2024. Interest rates have risen, of course, and mortgage payments have exploded as a consequence. It’s therefore not hard to see how this stokes anger in voter land.

The Governor was not alone in making such forecasts. Most of the chief economists at Australia’s big four banks were making the same predictions. However, anyone with a basic understanding of what the word “inflation” really means knew these predictions were nonsense.

Inflation is simply the expansion of the money supply as a consequence of government debt and money-printing deficit-spending.

Think of the money supply as a balloon. When you fill it with hot air, the balloon expands. That’s inflation.

The result for you and I? Higher prices!

For example, interest rates – which is a fancy way of saying ‘the price of money’ – go up. So it becomes necessary for lenders to ensure the money they lend today and receive in the future does not lose its spending power along the way.

Why are higher prices an inevitable consequence of the expansion of the money supply? Because the money fabricated by the government bids-up prices by competing with the money earned through wages and profits in the private sector.

When there is more money in the system,

but not more goods and services,

prices inevitably go up.

Consider the fish market for example. There is only so much fish at the market on any given day. If the government stands at the gate and hands $100 to everyone who enters the market, demand goes up, as people are willing to pay more with that extra cash in their hands.

During covid, the government stood at the gate dispensing money freshly minted for it by the RBA in exchange for government bonds. We’ll get to government bonds in a moment.

So did the RBA board not know about the nexus between the expansion of the money supply, price inflation and higher interest rates? Or did they simply lie about the future of interest rates?

Inflation is toxic because it distorts price signals in the otherwise free market, creates malinvestment, enables “crowding out” (a topic for another day) and destabilises the economy.

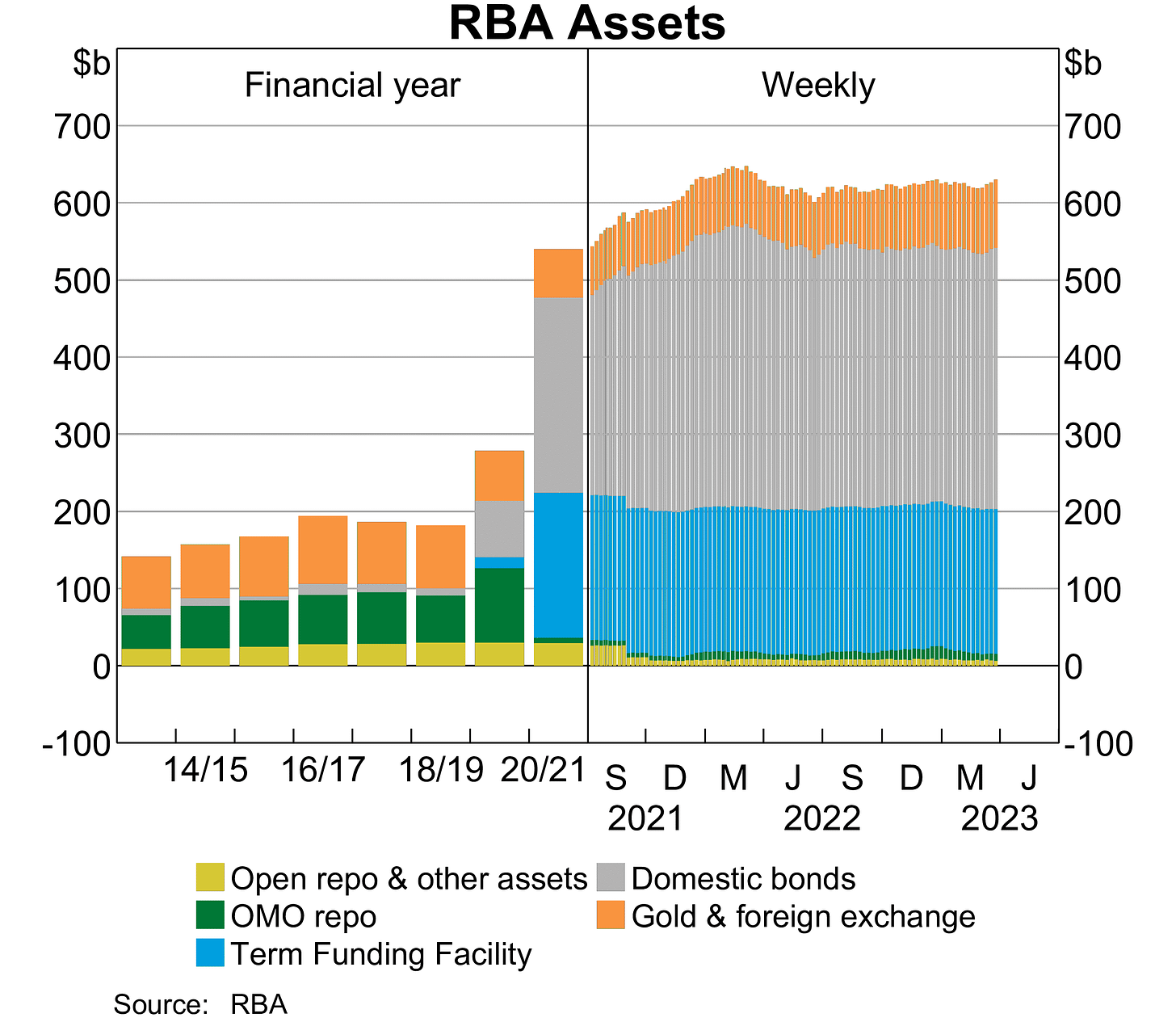

It’s a favourite party trick of mine to show people the graph below from the RBA’s monthly chart pack. Note the alarming expansion in government bonds (see the grey area on the graph) the RBA accumulated on its balance sheet when the government issued bonds like crazy to fund its reckless spending during covid. There’s your inflation right there, Governor. It’s in your own data!

Anyone with a simple grasp of basic economics takes one look at that chart and draws the obvious conclusion that higher prices were coming soon.

“Global supply chains”, “the war in the Ukraine”, “yadda yadda”. No! It was all the reckless debt-funded spending. They inflated the money supply and should have known that higher prices (and by extension higher interest rates) were inevitable in the short term, not way off in the future.

And just by the way, unions demanding wage rises are no more to blame for inflation as “greedy companies price gouging”. Pinning inflation on unions or businesses misses the point entirely.

Restructuring the RBA board will not solve the problem of economic ignorance. De-program aspiring board members of ‘Modern Monetary Theory’, ‘Keynesian Economics’ and other such nonsense. School them in microeconomics and Austrian school economics. Then RBA governance would not be in the news at all.

Thank you for your support. To help us in our battle to protect liberty and freedom please click here

Nicholas Samios is a fund manager and small business investor with a wealth of experience spanning three decades in commercial finance and SME capital raising. In his spare time, he puts on his “Austrian School” economist hat and utilises his insights from the commercial

world to analyse the economic landscape for SMEs and entrepreneurs.