The Liberals have announced a one-year tax offset that people will receive in 15 months. Other commentators have already noted that the policy is temporary and delayed, but my main concern is that the policy increases the marginal tax rate faced by a million Australian workers.

The policy has been described as a $1200 cash-back for many taxpayers, and that's true, but from an economic perspective what matters is the change in incentives. From that perspective, the policy involves five main changes:

(1) increases the effective tax-free threshold from $22,575 to $24,231.

(2) for people earning between $37k and $45k the marginal tax rate is cut from 23% to 14.5%

(3) for people earning between $45-48k the marginal tax rate is cut from 33.5% to 25%

Instead, the Liberals have managed to find almost the only tax cut in human history that undermines productivity!

(4) for people earning between $104-135k the marginal tax rate is raised from 32% to 35%

(5) for people earning between $135-144k the marginal tax rate is raised from 39% to 42%

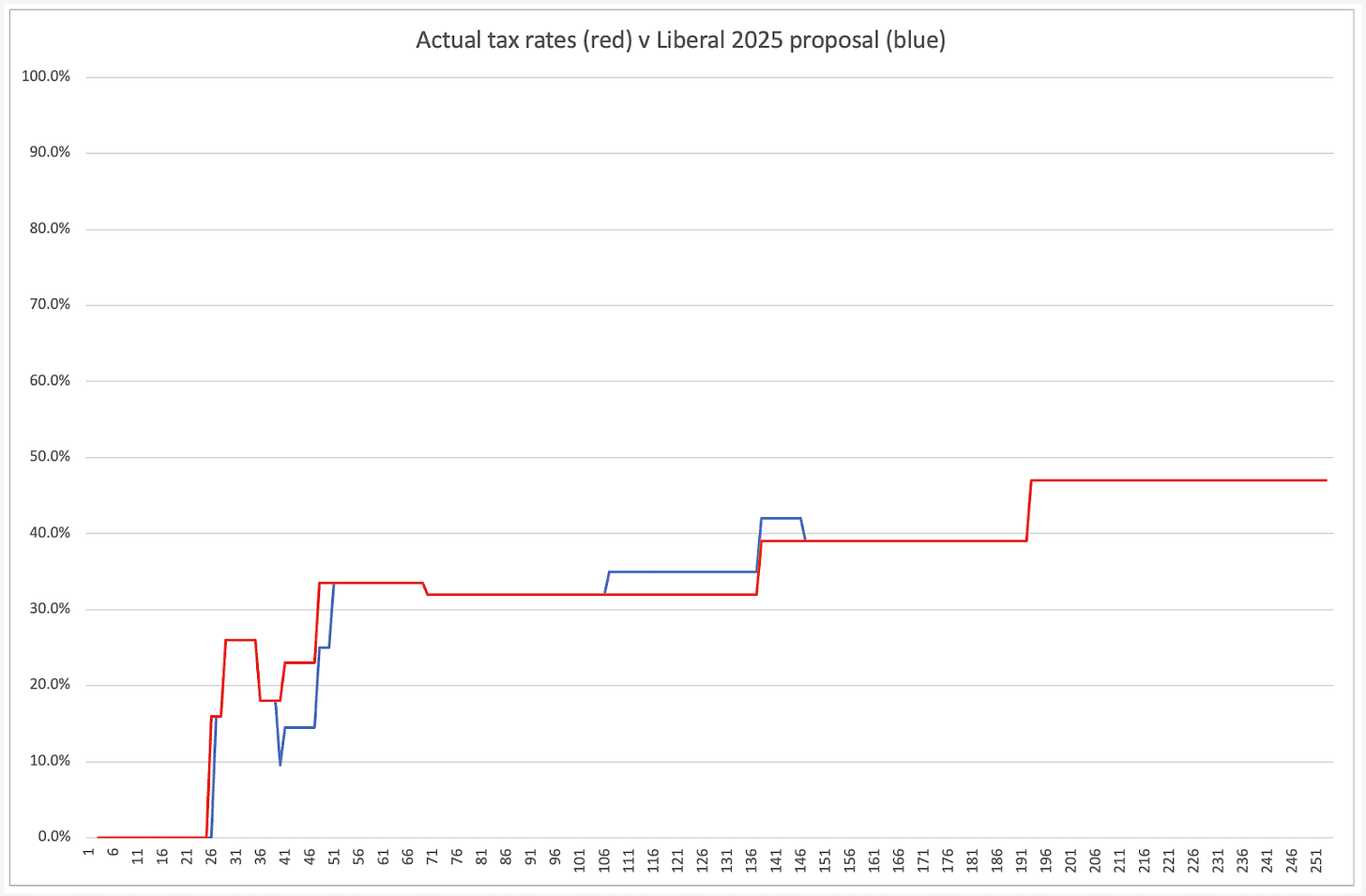

You can see the proposed tax changes in the graph below, which compares the status quo (red line) with the Liberal proposal (blue line). The proposed lower tax rates can be seen on the left of the chart, where the blue tax line is lower than the red tax line for people earning $37-48k.

The proposed higher tax rates can be seen in the middle of the chart, where the blue tax line is higher than the red tax line for people earning $104-144k.

Some may argue that people earning >$100k aren't the priority, but the elasticity data is clear that those people are much more likely to change their behaviour in response to incentives. We should be lowering their marginal tax rates, not increasing them!

By worsening the incentives for upwardly-mobile productive people, this policy may actually hurt the economy and cost the budget more than expected.

The policy increases the marginal tax rate faced by a million Australian workers.

There are so many good tax-cutting ideas that the Liberals could have chosen: index tax thresholds, allow family tax treatment, child tax credits, drop marginal tax rates, increase the top marginal threshold, remove the regressive steps in our tax system, allow standardised deductions, introduce tax-free savings accounts, integrate the tax and welfare systems, allow cashflow tax for small business, and so much more.

Instead, the Liberals have managed to find almost the only tax cut in human history that undermines productivity!

I can only assume that this idea does well in focus groups and opinion polls, but for people who care about genuine tax reform it is pretty disappointing.

I have no desire to discuss his post, the only comment I make to John Humphreys is, has he any intention of reducing tax paid by Australian citizens, apart from reducing tax demands on one hand and increasing them on the other?

The one year tax offset by liberals is typical government "generosity". Give with one hand but take away with the other.