Talkin’ About My Generation (Part 2)

(For Part 1, click here)

At a recent Senate Estimates hearing, Greens Treasury Spokesman Senator Nick McKim asked outgoing RBA Governor Philip Lowe, “On the supply/demand issue, are you aware of the work of economist Cameron Murray stating, at current rate of sales, there are twelve years of vacant land in Australia already zoned as residential?”

This question goes to the very heart of the problem – a total lack of understanding of how markets (in this case, housing) work.

There may well be twelve years supply of vacant land at current prices – over $400,000 per allotment.

If that is the criteria, then why not double the price and there’ll be 24 years supply!

If, however, land prices were what they should be – $100,000 per allotment – and there is no reason they should not be that price, how many years supply would there be?

I suspect it would be all sold in twelve months, not twelve years.

Recent tokenistic rezoning and land releases by some state governments – to great media fanfare – will no more make land affordable than the discovery of a new diamond mine will make diamonds more affordable.

The land development industry of course welcomes the new lode because they know how to manipulate and drip-feed finished allotments (like diamonds) to the market, keeping prices sky high.

So why does this zoned residential land cost upwards of two million dollars a hectare, when adjacent, agricultural land costs less than a tenth of that?

The reason is that whenever there is money to be made, opportunities to do business with governments present themselves – particularly in tightly controlled markets like land. Relationships between businesspeople and governments is as old as regulation itself.

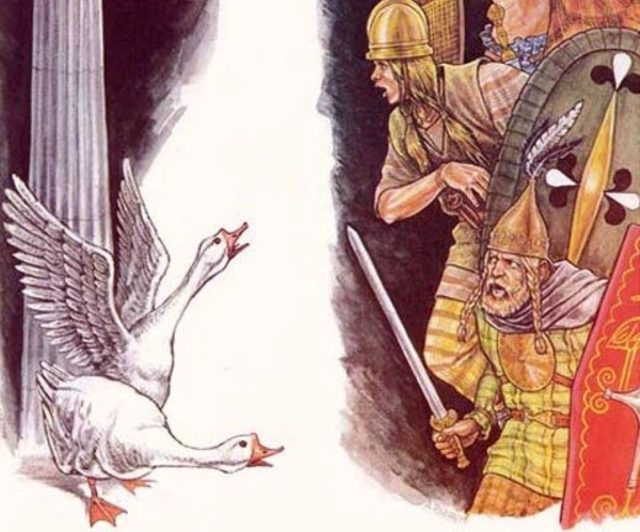

What gives these relationships real potency is called the ‘Baptists and Bootleggers’ phenomenon.

The term ‘Baptists & Bootleggers’ was coined during the 1920s Prohibition era in America. Makers of illegal liquor – ‘Bootleggers’ – made donations to elected officials (and to the ‘Baptists’ campaign to have alcohol banned) in order to maintain the ban. That led to sky high prices for their product. Members of Congress justified prohibition by publicly supporting the moral cause of the Baptists.

These days we call those Bootleggers ‘rent-seekers’.

Over the past 100 years, rent-seekers have perfected their dark art of extracting money from taxpayers and consumers.

They are everywhere – energy, superannuation, higher education, land development, indigenous groups, public transport, manufacturing – you name it. They are a scourge. They tarnish the political process, distort the market and in the case of so-called ‘renewable energy’, distort the entire economy.

Renewable energy rent-seekers have leapt onto the climate change bandwagon and are raking in billions of dollars gaming the system, raising energy prices, impoverishing consumers, destroying jobs, and fleecing taxpayers.

Along with unions and superfunds, pharmaceuticals and health, universities and higher education, these Australian oligarchs have limitless amounts of money to both shore up their own positions and resist anyone who might try to challenge them.

Previously, entrepreneurs went to the marketplace to make their fortunes. Today the public purse is the mother lode.

When the NDIS was announced in 2012, it was forecast to cost $14bn a year. In April 2022, actuary firm Taylor Fry estimated that by 2030 the cost will blow out to $64bn a year– a $50bn a year increase.

How did this happen in such a short period of time? Simple – professionalised politics and sophisticated rent-seeking.

So, back to land development. MPs receive donations from rent-seeking property developers. MPs then publicly support urban planners who rail against the so-called evils of urban sprawl. That leads to restrictions on urban growth which force people into high density housing developments in the inner suburbs – a classic example of the Baptists and the Bootleggers phenomenon at work.

It is also well-known that MPs themselves hop onto the property-owning bandwagon with numerous ‘investment properties’ of their own. Keen to maintain their wealth, they publicly support urban planning laws. Let’s call it ‘the monetisation of urban planning’.

The problem is, of course, that the younger generation of home buyers end up paying for all this. They are forced into overpriced apartments and prevented from achieving their primary ambition – a free-standing family home of their own.

Bootleggers have stolen both their wealth and their future.

For land to become affordable, the government should – as was the case with older suburbs – allow the development of basic serviced allotments – water, sewerage, electricity, stormwater, bitumen roads, street lighting and street signage. Additional services and amenities – lakes, entrance walls, palm trees, bike trails, etc – can be optional extras if the developer wishes to provide them and home buyers are willing to pay for them.

The government should also abolish up-front infrastructure charges and so-called ‘developer contributions’ imposed by local and state government departments. All infrastructure services should be paid for through the rates system – pay ‘as’ you use, not ‘before’ you use.

Bob’s contribution to the Australian community has been reflected in a wide range of appointments including National President of the Housing Industry Association, Co-Founder and Inaugural President of Independent Contractors of Australia, Director of The Centre for Independent Studies, and Senator for South Australia.