Is Australia Becoming Untenable?

How does a country go from being highly investible to completely uninvestible? In many cases this seemingly happens overnight.

Prior to the Chávez administration, Venezuela was a highly investible country, with an economy that was the envy of their South American counterparts. Now, thanks to an unstable socialist government and unexpected legislative changes, no prudent investor would put their money anywhere near Venezuela. In finance, this concept is known as legislative risk.

AUSTRALIA: LEGISLATIVE RISK-OFF

In Australia, we have always prided ourselves on an economy that punches well above our geopolitical weight. Despite being a small and distant country, we have adopted a favourable attitude towards foreign investment and maintained an active foreign exchange market with minimal capital controls. This has earned Australia AAA credit ratings and favourable dispositions from international bodies and foreign investors – as well as local investors.

Simply put, legislative risk means we all must consider whether Australia is stable enough to be worth investing in – and not just financially.

However, I cannot help the feeling that things are starting to change. During Covid, it did not take long for Australia to revert to its isolationist ways. By slamming our borders shut and keeping them shut well beyond many other countries, we began destroying our service and education industries – Australia’s biggest exports outside of the mining industry. While tourists and students are slowly returning to our shores, other legislative risks are beginning to present themselves.

LEGISLATIVE RISK BEYOND COVID

It is not just me that feels this way. Recently Binance, the biggest cryptocurrency exchange in the world, halted Australian-dollar deposits and withdrawals. It is evident their currency partner was simply unwilling to take on the growing risk of overburdening regulation in Australia’s financial sector. While Binance has assured Australian clients that Australian-dollar deposits and withdrawals will resume when they find a new partner, several months on they are all still searching. Is no one in the crypto space willing to touch Australia?

The danger of unexpected legislative change is a concept West Australian farmers are all too familiar with. While the WA Labor Government has backed down from requiring farmers and regional landholders to consult with indigenous communities regarding any changes they wish to make to their land or farming practices, more subversive versions of this legislation are on their way. Had the Voice to Parliament become a reality, this may have been something we all have to learn – and it may well still be via state and territory legislation.

Australian firearms owners and shooters have experienced legislative risk for decades, even if they were not aware of the term.

WHAT DOES IT ALL MEAN

Simply put, legislative risk means we all must consider whether Australia is stable enough to be worth investing in – and not just financially.

Is it worth pursuing higher education if the job you are studying for might be regulated out of existence?

… other legislative risks are beginning to present themselves.

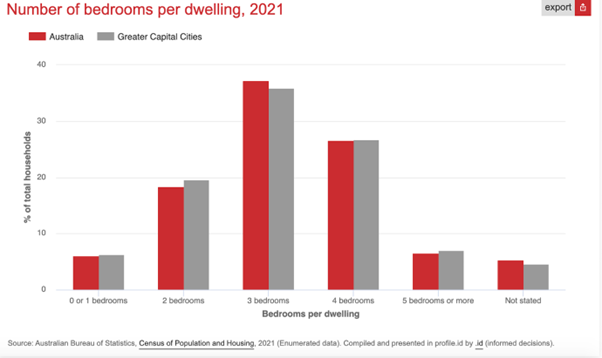

Is it worth buying property in Australia, whether you’re a buying your first home or you’re a foreign investor, if you are not sure how long it’s going to be before you’re paying indigenous rent?

Is it worth starting an alternative media platform if you are not sure how long it will take until you are shut down and fined by the Ministry of Truth?

These are just some of the questions we all must ask ourselves before we start a business, pursue a degree or start a family in Australia. They are certainly questions I find myself asking more and more frequently.

While always avidly following politics and culture, James Hol was not politically active until the overreaction to COVID. In a matter of months, James gained invaluable insight into all levels of government, being heavily involved in Federal, state and local election campaigns.